News

Martlet Capital spinning out to continue early-stage investment momentum

September 23, 2021

Martlet Capital is excited to announce an initial equity investment from high calibre investors, including Saranac Partners and NetScientific, the parent company of EMV Capital. This investment will allow Martlet Capital to acquire the existing portfolio of over 50 investments from Marshall of Cambridge (Holdings) Limited and continue to invest in UK based deep technology businesses.

The experienced team will maintain Martlet’s strong presence within the Cambridge start-up ecosystem. Support will continue for the existing portfolio companies, alongside the pursuit of new pre-seed and seed stage investment opportunities in three core areas of focus: deep tech, life sciences, and sustainable technologies.

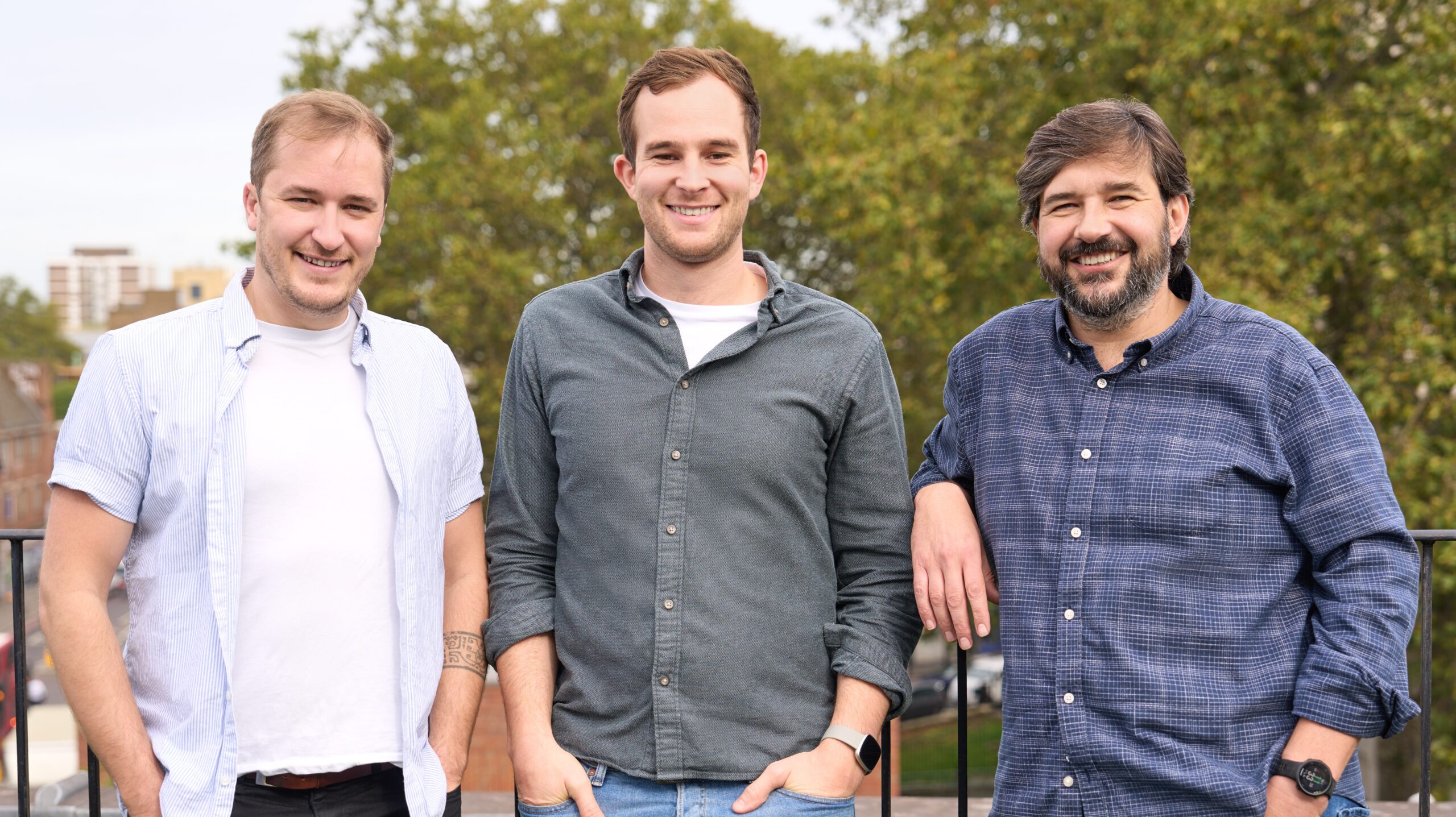

Martlet Capital’s team is led by Robert Marshall as Executive Chairman and Paul Bailey as Managing Director. The firm leverages its existing links, networks, and reputation in the Cambridge technology cluster, as well as a focused approach to executing early-stage investments.

Robert Marshall says “Martlet Capital will continue to be an important seed stage investor in the Cambridge deep tech start-up ecosystem. With an outstanding team and long-standing relationships with the University of Cambridge and the local technology and investment community we aim to be the seed stage funding partner of choice.

“The backing and partnership with EMV and Saranac substantially enhance our ability to invest in more deep tech companies. In addition, we are creating a follow-on fund called MarQuity, which will give us the ability to see these companies through inception all the way to exit.”

NetScientific CEO and EMV Capital MD, Dr Ilian Iliev says “This investment represents a significant step forward in EMV Capital’s growth path, through an expanded footprint, a new high-quality deal flow channel, increased Capital Under Advisory, and developing further opportunities to deploy our capital-light investment model.

“We are excited to work with Martlet Capital and Saranac Partners in building a unique proposition in the world-leading Cambridge cluster. The combination of Martlet’s early-stage investment focus and existing networks; EMV Capital and Saranac Partners’ follow-on investment support through MarQuity; and access to international growth opportunities provides a unique platform to nurture the next set of champions emerging from Cambridge.”

Investing alongside EMV Capital is Saranac Partners. Robert Crowter-Jones of Saranac Partners, adds “Saranac Partners was established for private investors to gain access to unique investment opportunities and ecosystems. We believe that the Martlet Capital’s team and portfolio creates a very exciting platform within intellectual property emerging from the Cambridge cluster, and will be a natural home for new technologies, entrepreneurs and investors.”

About Martlet Capital

Martlet Capital is an early-stage investor based in Cambridge, which has invested in more than 60 start-ups with high growth potential, since its launch in 2011. Martlet provides patient capital for IP rich, early-stage B2B start-ups, with a primary focus on deep technology and life science companies based in Cambridge. The team is comprised of experienced investors and entrepreneurs. In addition to capital, the team offer value beyond capital through support, experience, and a network of contacts. Over the last decade, they have achieved several exits from their portfolio, helping companies scale from first-round through to exit from trade sales to global technology companies and IPO’s.